massachusetts estate tax table

2022 Massachusetts State Tax Tables. The graduated tax rates are capped at 16.

Jessica Pesce Author At Ladimer Law Office Pc Page 2 Of 4

Schedule your free virtual consultation today.

. Ad Experienced Massachusetts Attorneys for Estate Planning Administration and Tax Law. The Massachusetts State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022. The imposed Massachusetts estate tax is determined by the percentage of the taxable estate which is real and tangible property located in Massachusetts.

Good news for small business owners. A Massachusetts estate tax return Form M-706 is required to be filed because the decedents gross estate prior to deductions exceeds the threshold. The Massachusetts estate tax is an amount equal to the federal.

Massachusetts lawmakers are considering an estate tax reform measure which would raise the threshold at which someone becomes. If the estate is valued at less than 6415500 million the taxable estate is then the. Heres how the actual calculation works.

65C 14f as amended and applicable to estates of decedents dying on or after January 1 1986 if Massachusetts farm property. 2 Massachusetts estate tax lien Under MGL. The state sales tax rate in massachusetts is 625 but you can customize this table as.

If you were to translate the amount owed into a tax rate on the portion of the estate that exceeds the Massachusetts exemption amount of 1 million the top rate would be 16that is you. The Massachusetts estate tax was decoupled from the federal estate tax beginning with deaths occurring in 2003. Massachusetts does levy an estate tax.

Schedule your free virtual consultation today. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. 1201-25000 - monthly filings.

Unlike most estate taxes the. The Massachusetts estate tax is. Over 25000 - quarterly.

101-1200 - quarterly filings. The Massachusetts estate tax threshold has been set at 1 million since 2006. Computation of the credit for state death taxes for Massachusetts estate tax purposes.

Massachusetts lawmakers are considering an estate tax reform measure which would raise the threshold at which someone becomes eligible to pay. Ad Experienced Massachusetts Attorneys for Estate Planning Administration and Tax Law. It is assessed on estates valued at more than 1 million.

First start with calculating your taxable estate. Good news for small business owners. Massachusetts Estate Tax Table.

Up to 100 - annual filing. Compare these rates to the current federal rate of 40 Deadlines for Filing the Massachusetts. Tax year 2022 Withholding.

A guide to estate ta mass gov massachusetts state estate tax law what is the estate tax in massachusetts key 2020 wealth transfer tax numbers. Massachusetts uses a graduated tax rate which ranges between 08.

2022 Transfer Tax Explained Bove And Langa

Estate Tax Rate Schedule And Unified Credit Amounts Download Table

Planning For Retirement How Attractive Is Massachusetts For Estate Tax Planning Don T Tax Yourself

Estate Tax In The United States Wikipedia

Will Ohio Estate Tax Repeal Trigger More

Moved South But Still Taxed Up North

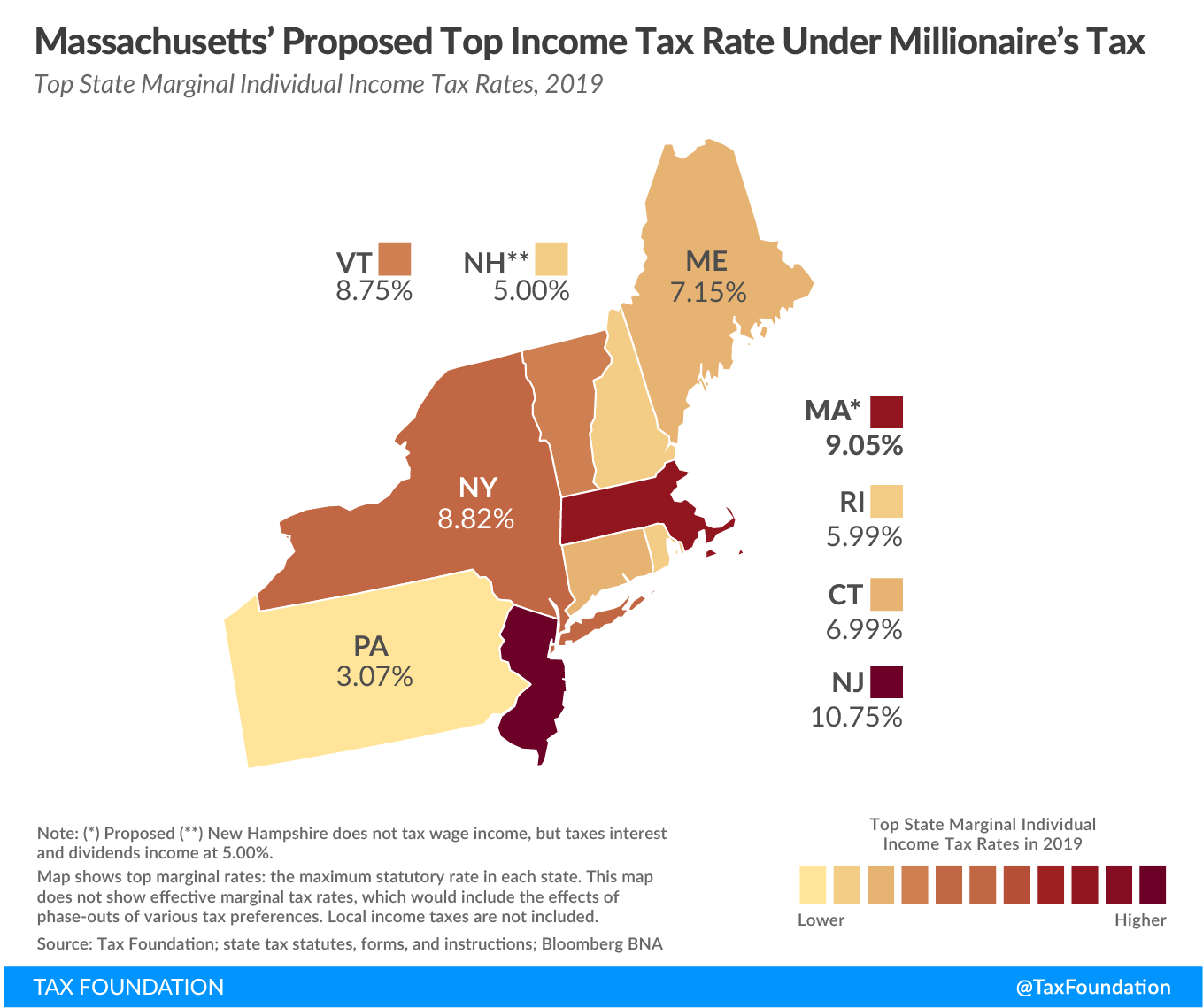

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

Massachusetts Estate And Gift Taxes Explained Wealth Management

State By State Estate And Inheritance Tax Rates Everplans

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

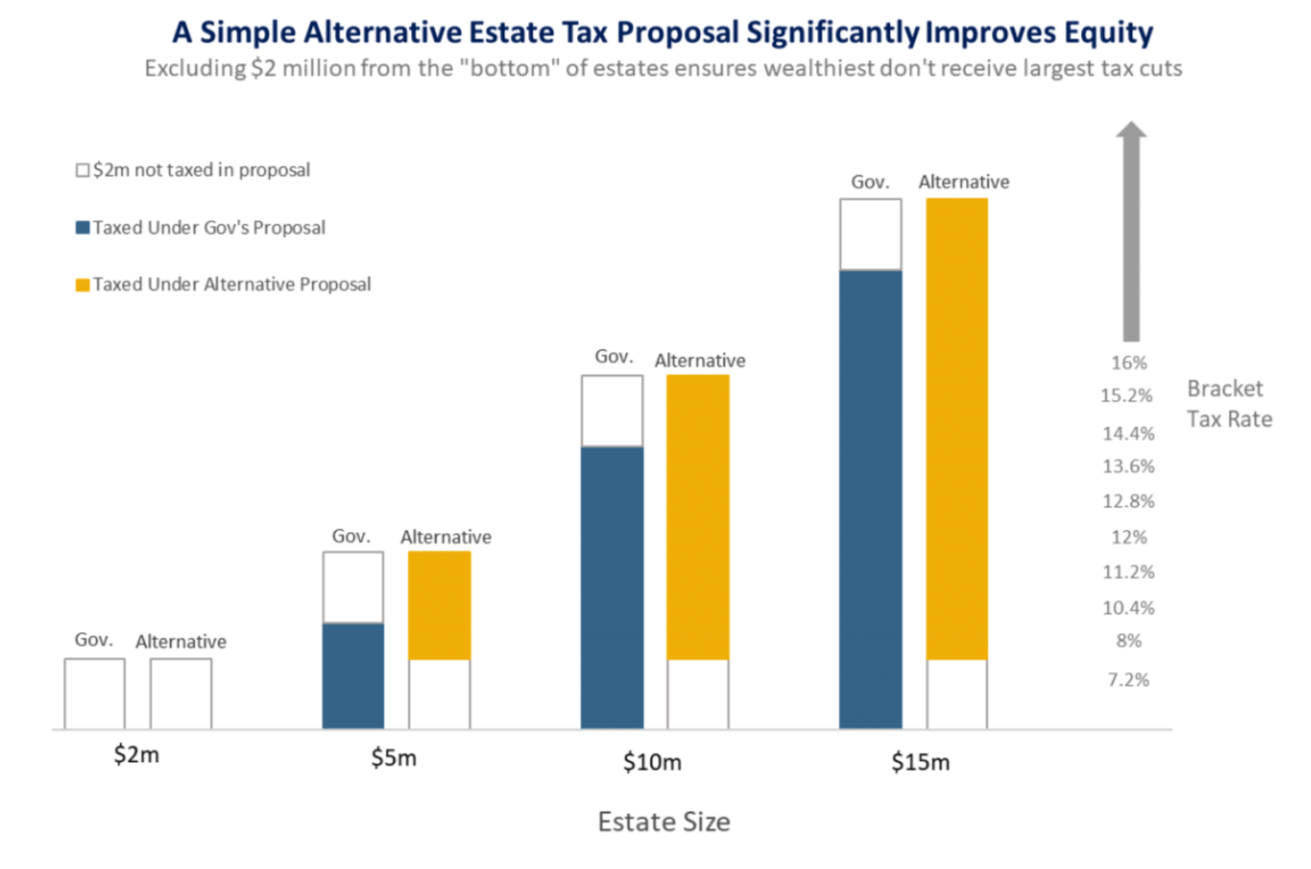

Current Estate Tax Proposals Would Give Largest Benefits To Wealthiest Estates Alternative Method Would Fix This Problem Mass Budget And Policy Center

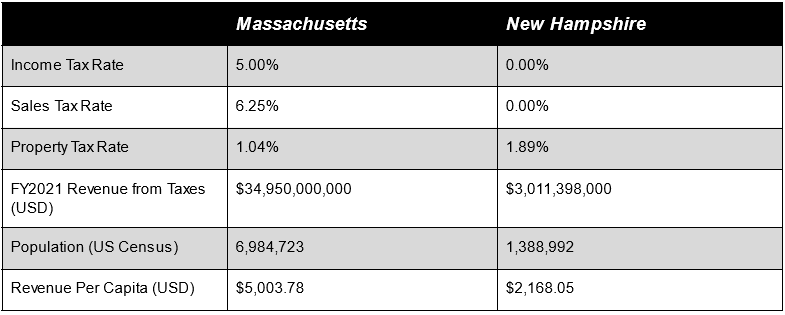

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Historical Massachusetts Tax Policy Information Ballotpedia

Condo Association Rules And Regulations Massachusetts

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg